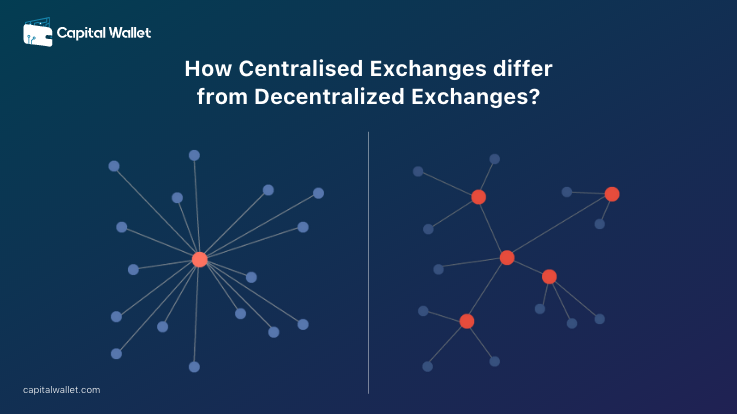

Centralized exchanges (CEX) and decentralized exchanges (DEX) are two types of cryptocurrency exchanges that allow users to trade digital assets. While both types of exchanges serve the same purpose, there are some significant differences between the two. Lets look at the table below:

| Feature | Centralized Exchanges (CEX) | Decentralized Exchanges (DEX) |

| Control | Controlled by central authority | Decentralized and operate on blockchain network |

| Security | More vulnerable to hacking and security breaches | Greater security due to decentralized nature and use of smart contracts |

| Privacy | Requires personal information for account verification | Greater privacy as no personal information required |

| Speed | Can process trades more quickly | May be slower as it relies on confirmation of multiple nodes on blockchain network |

| Liquidity | Generally higher liquidity | May have lower liquidity |

| Selection of Coins | Larger selection of coins available | May have a more limited selection |

| Custodial Risk | Higher custodial risk | Non-custodial, users hold their own private keys and assets |

| Regulations | More likely to be subject to government regulations | Operate in a more decentralized and unregulated environment |

In conclusion, the key differences between centralized exchanges (CEX) and decentralized exchanges (DEX) lie in their approach to user control, security, and transparency. While CEXs offer greater liquidity, trading volume, and ease of use, they are also more vulnerable to hacks and data breaches, and often require users to sacrifice control over their assets. On the other hand, DEXs provide users with greater control and security over their assets, but may lack the same level of liquidity and trading volume as CEXs. Ultimately, the choice between a CEX and DEX will depend on a user’s specific needs and preferences.