Regenerative finance (ReFi) is a paradigm shift in the way we think about finance. It goes beyond maximizing profits and instead, prioritizes the long-term impacts of financial decisions on people and the planet. This innovative approach is based on the principles of regenerative economics and seeks to create a more sustainable and equitable economy. At the heart of regenerative finance lies the belief in “regeneration” and “resilience” – the idea that financial systems can be designed to support and enhance the natural systems that sustain our economy and withstand economic and environmental shocks. The values of transparency, accountability, and ethical decision-making also play a significant role in this approach. The rise of technology and increasing awareness of sustainability is driving the growth of regenerative finance. It offers a promising solution for aligning financial goals with values and creating a future that is both prosperous and sustainable for all.

Regenerative finance is an innovative approach to finance that prioritizes the well-being of people and the planet. At the center of this new way of thinking about finance are several key principles and values. One such principle is intergenerational equity, which ensures that financial decisions consider the well-being of future generations. Social responsibility, on the other hand, ensures that financial systems benefit all members of society. Environmental sustainability is also crucial in regenerative finance, as it focuses on reducing the impact of financial activities on the natural world. Transparency is another core principle of regenerative finance, making financial systems accessible and transparent to all members of society. Overall, regenerative finance offers a new path towards creating financial systems that are sustainable and equitable, benefitting both people and the planet.

Regenerative finance and traditional finance are two opposing approaches to finance, with stark differences in their priorities, values and outcomes. Traditional finance prioritizes financial returns, focusing on maximizing profits through short-term investments and financial instruments, with little regard for their long-term consequences. In contrast, regenerative finance prioritizes sustainability, social responsibility, and environmental conservation, and focuses on creating financial systems that benefit both people and the planet. It invests in initiatives such as renewable energy and sustainable agriculture that promote environmental conservation and sustainability.

Regenerative finance (ReFi) can make financial information and data accessible to all, while traditional finance often lacks transparency. This is a major difference between the two.

This is a major difference between the two. Critics have often criticized the impact of traditional finance for exacerbating social and environmental problems. However, regenerative finance aims to address these issues. In conclusion, regenerative finance has the potential to transform the financial world and create a more equitable and sustainable future for all, by prioritizing sustainability, social responsibility, and environmental conservation.

The role of technology in Regenerative Finance (ReFi)

The rise of technology is playing a crucial role in the growth of regenerative finance. This approach to finance aims to restore and regenerate natural systems while also generating financial returns, promoting the well-being of the planet and its inhabitants. Technology has enabled the creation of new financial instruments, such as impact investing platforms, which provide investors with access to sustainable investment options. Data and analytics, generated by technology-enabled devices and systems, have helped to inform investment decisions and measure their impact. Digital currencies and blockchain technology have increased transparency in financial transactions and reduced the risk of fraud. Crowdfunding platforms have also democratized access to finance and opened up new opportunities for financing sustainability initiatives. Technology will continue to play a crucial role in the development of regenerative finance, driving the transition towards a more sustainable financial system.

Community Development Finance Institutions (CDFIs) are crucial in advancing regenerative finance principles. CDFIs offer capital, loans, and financial services to marginalized communities, including low-income individuals, small businesses, and communities of color. Their main objective is to promote positive social and environmental impact and support the transition to a sustainable financial system. CDFIs invest in businesses and initiatives that advance sustainability, community development, and environmental protection, such as renewable energy projects, affordable housing, and local food systems. In addition, CDFIs provide loans and financing to individuals and businesses that traditional financing options exclud

Additionally, CDFIs are embracing technology to enhance regenerative finance (ReFi). They use digital platforms to connect borrowers and lenders and provide financial services and information, increasing their reach and impact. Data and analytics also help CDFIs make informed investment decisions and measure their investments’ impact. CDFIs play a vital role in advancing a more sustainable financial system, democratizing access to finance, and promoting positive social and environmental impact. By providing capital and financial services to underserved communities, CDFIs are supporting the shift towards a more sustainable future.

Regenerative finance (ReFi) practices are gaining momentum with the support of local and regional banks and credit unions. Community-based financial institutions are in a good position to promote and support initiatives that have a positive impact on the local economy and environment. To support regenerative finance, these institutions invest in local businesses and initiatives promoting sustainability and environmental stewardship, such as renewable energy projects and affordable housing. They also provide loans and financing to individuals and businesses who may not have access to traditional financing options.

Furthermore, local and regional banks and credit unions are using digital platforms to connect borrowers with lenders and provide access to financial services and information, increasing their reach and impact. The use of data and analytics also helps these institutions make informed investment decisions and measure their impact. By providing access to capital and financial services to underserved communities, these institutions are helping to democratize finance and support the transition towards a more sustainable future, while also making a meaningful impact on the local community.

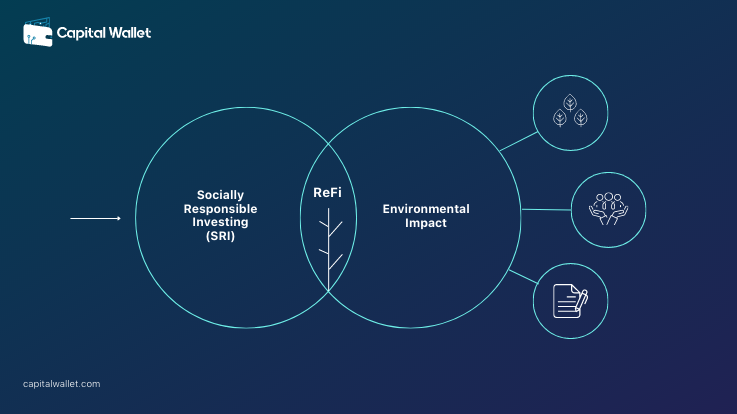

Socially Responsible Investing (SRI) and Regenerative Finance (ReFi) are two investment strategies that focus on aligning investments with the investor’s values and creating a positive social and environmental impact. SRI considers both financial returns and the social and environmental impact of investments, whereas Regenerative Finance takes SRI a step further and actively seeks to regenerate and restore natural systems. Both approaches involve screening companies based on social and environmental factors, with investment options including individual stocks, mutual funds, and ETFs. Some investment platforms specialize in SRI and Regenerative Finance, offering tailored investment portfolios and educational resources. Ultimately, both SRI and Regenerative Finance provide investors with an opportunity to make a positive impact on the world and create a sustainable future for generations to come.

Looking for ways to align your investments with your values and create a positive impact on the environment? Look no further than green bonds and sustainable debt. These financial instruments are part of the growing regenerative finance (ReFi) movement that actively works to restore and regenerate the natural systems that support life on earth. Green bonds are debt securities issued to finance environmentally friendly projects like renewable energy and energy efficiency, while sustainable debt is issued by companies committed to sustainable business practices. Both offer a way to support positive environmental initiatives while earning a financial return. You can find investment options like individual bonds, mutual funds, and ETFs that specialize in green bonds and sustainable debt. Whether you’re a seasoned investor or just starting out, investing in green bonds and sustainable debt can help you make a difference and build a sustainable future for generations to come.

Regenerative finance (ReFi) is the new trend in investment that aims to actively restore and regenerate the natural systems supporting life on earth. It is not just popular among individual and institutional investors but also among small businesses and entrepreneurs. There are several benefits of regenerative finance for small businesses and entrepreneurs. First and foremost, regenerative finance provides small businesses with access to capital, an alternative source of funding that aligns with their values. Secondly, it promotes sustainable business practices, which not only benefits the environment but also improves the reputation of the business.

Thirdly, it helps small businesses stay ahead of technological and societal trends, by investing in cutting-edge technologies and solutions that promote sustainability. Fourthly, it offers a sense of purpose and fulfillment for small business owners, as they align their investments with their values and make a positive impact on the world. Finally, it provides a way for small businesses to build a sustainable future for themselves and their communities. In conclusion, regenerative finance is an excellent investment strategy for small businesses and entrepreneurs to grow, succeed, and make a positive impact on the world.

Regenerative finance (ReFi) is a unique investment strategy that aims to revive and preserve the natural systems supporting life on earth. However, despite its growing popularity, many are still unaware of what it truly entails. That’s why education and awareness are crucial in the field of regenerative finance. By providing investors and decision-makers with a deeper understanding of its principles, it helps build a more conscious and engaged community. Additionally, education and awareness can break down barriers to entry, making regenerative finance more accessible and encouraging more people to invest in sustainable initiatives. Furthermore, education drives innovation in the field, promoting progress and advancing its principles. Ultimately, educating the masses about regenerative finance helps build a more resilient and sustainable future, benefiting future generations. Whether you’re an investor, entrepreneur or just a concerned citizen, take the time to learn about regenerative finance and contribute to building a better future.

Regenerative finance (ReFi), a new approach to financing that prioritizes sustainable development, is poised to transform the world. However, the road ahead is full of challenges that must be addressed. The lack of understanding and awareness about the concept, a lack of standards and transparency, barriers to access to capital, and challenges related to regulation and policy, are all major roadblocks to the widespread adoption of regenerative finance.

In order to ensure its success and growth, it is crucial to overcome these challenges and make regenerative finance more accessible, transparent, and regulated. By doing so, we can promote a more sustainable future and drive positive social and environmental outcomes through investment. Whether you are an investor, entrepreneur, or concerned citizen, it is time to take action and support the growth of regenerative finance, so that together we can create a better future for all.

Governments’ role in advancing the principles of regenerative finance and promoting sustainability. They can support the growth of regenerative finance by providing tax incentives and subsidies, establishing standards and guidelines, investing directly in regenerative projects, and engaging in education and outreach efforts. Governments can reduce the cost of investment by offering tax credits for renewable energy projects, funding for green infrastructure initiatives, and other sustainable initiatives. By establishing standards and guidelines, governments can increase transparency and accountability in the industry, providing investors with greater confidence in their investments. Additionally, governments can invest directly in regenerative projects and collaborate with private organizations to develop investment products aligned with regenerative finance principles. By promoting awareness and education, governments can increase public understanding of regenerative finance and its benefits, leading to greater investment in sustainable initiatives. Overall, the role of governments in promoting regenerative finance is crucial for its success and widespread adoption.

The future of regenerative finance looks promising as it gains traction among individuals, institutions, and governments. The growth of regenerative finance is driven by several factors, including the increasing interest in sustainable and socially responsible investing, awareness of the need to regenerate natural systems and address environmental degradation, advances in technology and data analysis, the trend towards ESG investing, and the increasing interest in impact investing. These factors are making it easier for investors to assess the impact of their investments on the environment and society, choose initiatives with a positive impact, and pursue investments that provide financial returns and promote sustainability. With all these driving forces, the potential for growth in the regenerative finance market is significant and the trend is expected to continue in the coming years. Now is the time to explore the opportunities in regenerative finance and join the movement towards a better future for all.