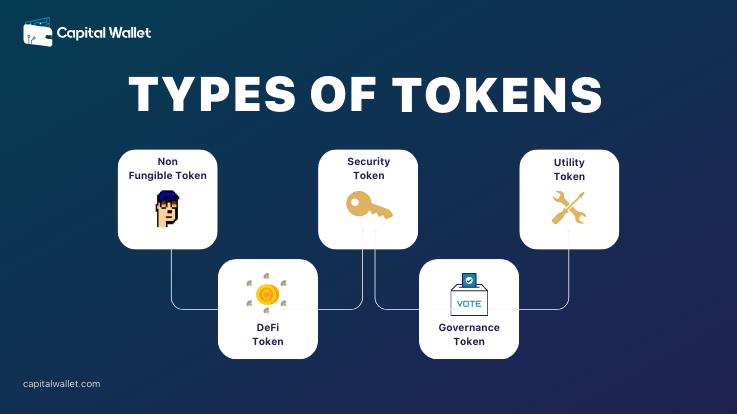

Crypto tokens are versatile digital assets that can be used for a variety of purposes, and they come in different types. Some of the most common types of tokens include utility tokens, security tokens, payment tokens, governance tokens, and non-fungible tokens (NFTs). The value and utility of tokens can vary depending on the usage on specific blockchain or decentralized application (dApp) as each type of token has its own unique characteristics and uses. Understanding the different types of tokens can help investors and users navigate the complex world of cryptocurrencies and blockchain technology. Lets look at them in detail here;

Non Fungible Token

Non-fungible tokens (NFTs) are like digital fingerprints – no two are exactly the same.

NFTs are unique and cannot exchange on a one-to-one basis for other tokens or assets, unlike traditional cryptocurrencies like Bitcoin, which are interchangeable for other cryptocurrencies or fiat currency. They represent ownership of a specific digital asset, such as a piece of art, a collectible, or even virtual real estate. NFTs prove ownership and authenticity of a digital asset in a tamper-proof way, similar to how a person’s fingerprint is unique.

Security Token or Equity Token

The concept of this type of token is generated from the traditional finance where securities (like stocks) are commonly defined as hold of ownership of publicly traded organizations on global exchanges.

Similarly these are also serves as securities of a company. It also represents a ownership of a company issuing the token to raise funds just like we explained a token with the theme park analogy in the beginning.

While it may not be practical for a security token to adhere to every single regulatory requirement in every corner of the world, companies can still ensure compliance with the majority of regulations by limiting access to the token based on the buyer’s identity and location. By doing so, the token can act as a virtual bouncer, only allowing those who meet the necessary criteria to enter the exclusive club of ownership.

Utility Token

The blockchain-based products or services accessed by using utility tokens. The tokens drive network activity to support the platform’s economy, while the platform provides security for the tokens, creating a symbiotic relationship between the two.

The Brave browser or Golem uses utility tokens like the Basic Attention Token to provide users with access to blockchain-based products or services and allow them to pay for services within the related ecosystem.

DeFi Token

Interconnected ecosystem of decentralized tokens aim to offer similar traditional finance system services like lending, saving, insurance and trading.

Decentralized finance (DeFi) tokens command a $39.73B, market cap, a relatively tiny proportion of the whole digital asset market, which makes this sector a fastest growing sector in this space.

Governance Token

A decentralized network powered by blockchain technology in which holder’s has a right to say or in simple sense has the voting right with which they can participate in the decision making process.

Governance tokens are like the “membership cards” of the blockchain. It allow holders to vote on proposals and help shape the direction of the network. Developers, investors, and other stakeholders can use governance tokens to fund development, propose changes to the protocol, vote on proposals, and perform other actions related to the blockchain ecosystem.They give you the right to have a say in the decisions that shape the direction of the network, and they allow you to contribute your ideas, vote on proposals, and help guide the network towards its goals.