Are you ready to join the cryptocurrency-digital currency revolution?

Surely, you can’t sit back after reading this!

Cryptocurrency is leading the charge, offering a decentralized and innovative way to make transactions and store value.

Cryptocurrency is a type of digital money that uses blockchain technology to run decentralised. This makes decentralized systems possible, enabling a network of computers to create, transfer, and verify transactions instead of relying on a single central authority.

The most well-known cryptocurrency is Bitcoin, however there are countless others with different features and traits. Some cryptocurrencies aim to function as a store of value, such as digital gold, while others intend to function as a medium of exchange like traditional currencies. Developers design some cryptocurrencies with specific purposes in mind, such as facilitating smart contracts or decentralized agreements.

Whatever the case, Bitcoin is a ground-breaking technology that has the ability to upend established financial structures and alter the way of developing thoughts around this.

Cryptocurrencies use a decentralized and encrypted ledger called the blockchain to record transactions. The blockchain’s security lies in its lack of central control, and any changes require the consensus of the entire network.

Digital wallets use public and private keys to ensure secure cryptocurrency transfers. The owner shares the public key to receive payments, while the private key, kept confidential, grants access to the wallet’s funds. It is important to keep the private key secure to protect the wallet’s funds.

Cryptocurrency’s Journey from Niche to Mainstream: A Look Back and Ahead

We can trace the history of cryptocurrencies back to 2008 when an individual or group using the pseudonym Satoshi Nakamoto published the Bitcoin whitepaper.The emergence of numerous cryptocurrencies over the past few years has generated a wide variety of features and uses.

Despite their popularity and success, cryptocurrencies continue to pose many unanswered questions and challenges as they remain a new and rapidly evolving technology.

Cryptocurrency has come a long way since its inception in the late 1980s. It has grown from a niche technology to a widely accepted form of payment and asset class. The decentralization and lack of regulation of cryptocurrency provide users with a high level of control over their transactions.

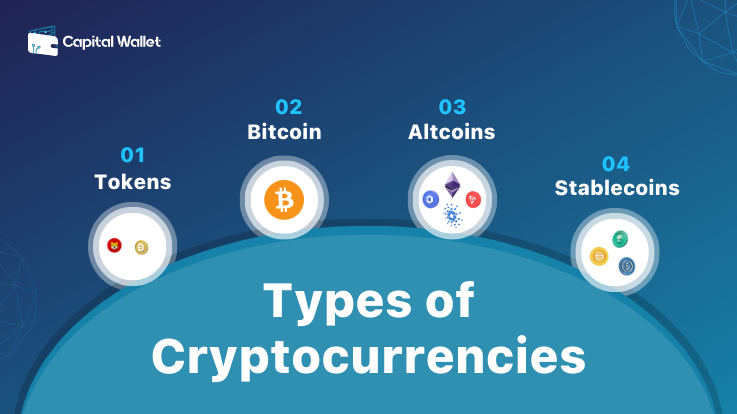

A Closer Look at Cryptocurrency: Categorizing the Different Types

Certainly, there are many types of cryptocurrencies depending on the usage of each are classified into Altcoin, Stablecoins, CBDCs, Tokens and few more into the developmental stages.

This is just a sampling of the many different categories of cryptocurrencies that exist.

Do you feel tired of relying on traditional financial institutions for your payment transfers?

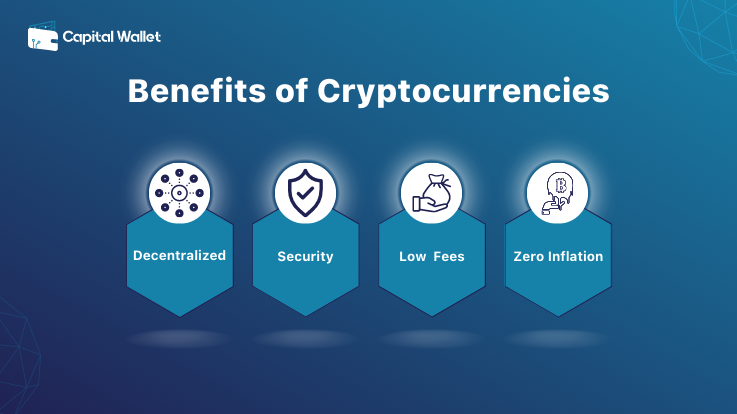

The Advantages of Cryptocurrency: A New Era of Financial Freedom

Discover the many benefits of cryptocurrency, including instant money transfer, full control over your digital assets, and cutting-edge cryptography for security.

With the benefits of cryptocurrency, you no longer have to rely on traditional financial institutions for your money transfers and asset management. Learn how cryptocurrency is revolutionizing the way we think about money and finance.

Process of creation of cryptocurrencies is similar to how a gold miner searches for gold, but instead of panning for the shiny metal in a river, a cryptocurrency miner uses their computer to solve complex mathematical problems.

A miner receives a certain amount of the cryptocurrency as a reward when they successfully solve one of these problems. This process helps to verify transactions on the blockchain, the decentralized ledger that underlies most cryptocurrencies.

But why go through all this trouble? Well, mining helps to secure the cryptocurrency network and make it resistant to tampering or fraud. It also serves as a way to introduce new units of the cryptocurrency into circulation.

You might be wondering, “If anyone can mine cryptocurrency with their computer, won’t the market become flooded with new coins?” This is a valid question. To prevent this, many cryptocurrencies have mechanisms built-in that make mining progressively more challenging over time.

This mechanism ensures a slowdown in the creation rate of new units as the supply increases.

Unlocking the Potential of Cryptocurrency for B2B Use Cases: Use Cases and Success Stories

Crypto B2B use cases are numerous, with the most prominent being the ability to conduct seamless cross-border transactions.

Businesses can leverage the power of cryptocurrencies to make and receive payments from any part of the world, bypassing the need to deal with exchange rates or incurring international transaction fees. This feature is particularly beneficial for small businesses that may not have access to traditional international payment methods.

Push for Regulation: Examining the Pros and Cons of Cryptocurrency Oversight

The decentralized nature of cryptocurrencies and their deviation from traditional finance has caused concern among many nations regarding their potential use in the financial sector. Cryptocurrency regulation is a controversial and complex issue, as it involves balancing the need for investor protection and preventing financial crimes with the desire to foster innovation and growth in the market. Some people argue that regulation is necessary in order to protect investors from fraud and ensure that there is transparency and fairness in the market. Others, however, argue that too much regulation could stifle innovation and make it more difficult for new cryptocurrency projects to emerge.

There are many different approaches to regulating the cryptocurrency market, and different countries have taken different approaches. Some countries, such as China, have implemented strict regulations that have effectively banned the use of cryptocurrencies, while others, such as the United States, have taken a more lenient approach and have allowed the market to develop more freely.

In general, the trend has been towards greater regulation in recent years, as governments and financial institutions have sought to bring greater clarity and oversight to the market.

Ultimately, the appropriate level of regulation in the cryptocurrency market will depend on the specific goals and needs of the community. It is important to strike a balance between protecting investors and preventing financial crimes, while also allowing for innovation and growth in the market.

Securing Your Crypto: Choosing the Right Wallet for Your Needs

A cryptocurrency wallet stores a user’s private and public keys, allowing access to and management of their cryptocurrency holdings.

These wallets can be used to send and receive digital currencies, as well as to view the balance of the user’s account. They can be software-based, such as a mobile or desktop wallet, or they can be hardware-based, such as a physical device that stores the user’s keys offline. The most common wallet used is software based and is a hot wallet, which means it is connected to the internet for transactions.

Cryptocurrency mining has been criticized for its environmental impact as it requires large amount of energy consumption. As we know, the process of mining includes solving complex mathematical problems which results in creation of new blocks in the blockchain. This process consumes significant amount of energy and thus makes it a timely and relevant topic for those who are concerned about the environmental impact of digital currencies.

Crypto and the Climate Crisis: Understanding the Environmental Impact of Cryptocurrency Mining

The environmental impact of cryptocurrencies is a growing concern as the energy consumption required for mining.

There are ongoing efforts to address the energy consumption of cryptocurrency mining, including the development of more energy-efficient algorithms and the use of renewable energy sources to power mining operations. However, it is important to note that the energy consumption of the broader financial system, including traditional banks and payment systems, is also significant and has an environmental impact as well.

There’s no such thing as a free lunch.” and yes it’s true in cryptos too.

Well it’s all said and done, summarising the topic;

Cryptocurrencies have the ability to upend established financial structures and build a more decentralised financial ecosystem. Experts predict that cryptocurrencies will constitute 25% of national currencies and gain wider acceptance among merchants and consumers by 2030. It is crucial to note that the volatile nature of cryptocurrencies is likely to cause price fluctuations.

The future of cryptocurrency market is uncertain and it is still a relatively new technology. However, it is likely that as the technology matures and more people become familiar with it, the use and acceptance of cryptocurrencies will continue to grow. Some experts predict that cryptocurrencies will eventually become mainstream and widely adopted as a form of payment, while others believe that they will remain a niche market. Ultimately, the future of cryptocurrencies will depend on the rate of adoption and the ability of the technology to address current challenges such as scalability and security.

Happy Hodling!

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.