Are you tired of the same old payment methods and unawared about crypto as payments? Want to be on the cutting edge of technology?

Look no further than cryptocurrency!

As digital currencies like Bitcoin, Ethereum, and Ripple continue to go mainstream, more and more businesses are starting to accept them as a form of payment. Imagine the possibilities: faster, secure transactions without the need for intermediaries, and even the potential to reach a global market. Don’t get left behind, read on to discover how your business can join the crypto revolution and take the first step towards a digital future.

Cryptocurrency is a digital token that can be exchanged for goods and services on the internet, using blockchain technology for decentralization and transaction management. Supporters argue that cryptocurrency has the potential to become a widely-used currency in the future, bypassing traditional intermediaries and offering a higher level of security. There are several types of cryptocurrencies such as Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash, and Tether, each with their own unique characteristics and use cases.

Bitcoin is considered the “gold standard” but other altcoins like Ethereum and Ripple are gaining popularity for their specific use cases like decentralized applications and fast cross-border transactions. Crypto payment service providers act as intermediaries for accepting and making payments in cryptocurrency, making it easier for merchants to accept payments both online and in physical locations. The adoption of cryptocurrency as a payment method is still in its early stages but it is a growing trend that is likely to continue in the future.

Cryptocurrencies, like Bitcoin and Ethereum, are gaining popularity as a payment method, with an increasing number of merchants accepting them. Companies such as Microsoft, AT&T, and Subway are among those accepting digital currencies, and cryptocurrency-based debit cards are also on the rise, allowing individuals to spend digital assets like traditional currency. Surveys show that 36% of US online merchants would consider accepting cryptocurrencies, and around 2% of all Bitcoin transactions were used for online purchases. While still in its early stages, adoption of cryptocurrencies as a payment method is a growing trend that is likely to continue.

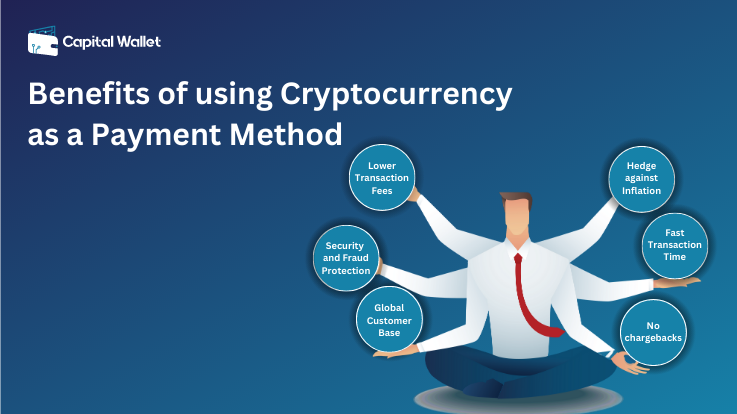

Businesses have several options for accepting cryptocurrency payments, including online platforms, point-of-sale systems, mobile wallets, and invoicing. These methods allow businesses to accept payments in various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. By accepting cryptocurrency payments, businesses can tap into a growing market and benefit from the security and low transaction costs of these digital currencies. However, when comparing the fees and transaction times of different cryptocurrencies, it is also important to consider other factors such as security, volatility, and regulatory environment. Additionally, it may be useful to compare these fees and transaction times to traditional payment methods such as credit cards or wire transfers and to consider the benefits and drawbacks of using cryptocurrencies for payments.

With the increasing popularity of cryptocurrencies, businesses and individuals are looking for ways to make transactions more efficiently and cost-effectively. One way to achieve this is by using altcoins, which are digital currencies other than Bitcoin. Many altcoins have lower fees and faster transaction times than Bitcoin, making them more attractive options for certain types of transactions.

One example of an altcoin with low fees is Litecoin. Litecoin has a faster block confirmation time than Bitcoin, which allows for faster transaction processing. Additionally, Litecoin’s transaction fees are significantly lower than Bitcoin’s, making it a more cost-effective option for small transactions.

Another altcoin that is known for its low fees is Ripple. Ripple’s consensus protocol allows for faster transaction processing than Bitcoin, and the fees for sending Ripple are extremely low. This makes it a great option for businesses that need to make large numbers of small transactions.

It’s important to note that these coins are also more volatile than Bitcoin and have a different market capitalization. Thus, it’s always important to do your own research and consult experts before making any financial decision.

The utilization of crypto as a mode of payments is on the rise as an increasing number of businesses are acknowledging the advantages of digital currencies. A number of companies and organizations have begun accepting Bitcoin as a form of payment.

For example, technology giant Microsoft began accepting Bitcoin as payment in 2014 for various products and services on its Windows and Xbox platforms. Online retailer Overstock.com was one of the first major companies to start accepting Bitcoin as payment in early 2014. The travel booking website Expedia also began accepting Bitcoin for hotel bookings the same year. Electric vehicle manufacturer Tesla has started accepting dogecoin as payment for its merchandise in March 2021.

Other examples include the notorious torrent site The Pirate Bay, which began accepting Bitcoin as a donation in 2013. E-commerce platform Shopify also began offering merchants the option to accept Bitcoin in 2013, and some Subway franchise locations in the US and Canada began accepting Bitcoin as payment in 2013.

The adoption of cryptocurrency as a form of payment is increasing as more and more businesses are recognizing the benefits of using digital currencies like Bitcoin. These benefits include security, low transaction costs, and the ability to reach a global market. The increasing adoption of Bitcoin as a form of payment is a positive development for the cryptocurrency and blockchain industry, as it demonstrates the growing mainstream acceptance of these technologies.

Accepting crypto payments can be a valuable addition to your business, but it requires proper research, preparation, and implementation. By selecting a reputable payment processor, creating a cryptocurrency wallet, integrating it into your system, testing and complying with regulations, educating yourself and your staff, monitoring transactions and market trends, providing clear instructions to customers, and regularly reviewing and updating security measures, you can ensure a smooth and secure process for accepting cryptocurrency payments. It is important to consult with legal, financial and technical experts throughout the process to make sure that you are following all the regulations and laws.

The intersection of cryptocurrencies and web3 technologies allows businesses to accept crypto payments in a decentralized way through decentralized finance (DeFi) platforms. These platforms, such as Uniswap, Aave, Compound and MakerDAO, enable businesses to accept payments in various cryptocurrencies and provide additional features like smart contract-based escrow and dispute resolution. Additionally, non-fungible tokens (NFTs) built on the Ethereum blockchain enable businesses to create and sell unique digital assets. However, it’s important to note that the use of these technologies is still in its early stages and businesses must exercise caution and comply with local regulations and laws.

The future of cypto as a means of payment is looking more promising than ever. As more and more merchants and businesses adopt the use of cryptocurrencies, and new technologies like blockchain make it easier to use and understand, it is likely that we will see a significant increase in the adoption and acceptance of digital currencies as a valid form of payment. Despite the challenges that come with using digital currencies, such as volatility and regulatory hurdles, the potential benefits of using crypto as a payment method make it an exciting prospect for the future of commerce.

The process of making payments using digital currencies can be daunting for those new to the world of crypto. The risk of making mistakes, such as sending the wrong type of cryptocurrency to a specific address, can lead to significant financial losses. To address this, crypto service providers have developed user-friendly payment methods that simplify the process, making it more foolproof and easier to navigate. With the use of digital invoices and QR codes, paying for goods and services, or sending funds to friends and family can be done with just a few quick clicks, making it a safer and more convenient option for all.